The Ultimate Guide to Choosing the BEST Broker

When it comes to the financial markets, selecting the right broker is ESSENTIAL.

Particularly for newer, it’s easy to become overwhelmed with confusing features and statistics. Therefore, it is a time most require a helping hand – somebody to explain the ins and outs if you will.

Why Trust Us?

The Broker Review website is a leading resource for online. Created by for, our research provides insightful information and extensive comparisons, exploring 100s of brokers. Our recommendations, therefore, not only help newer, but also old hands as well.

Security, regulation, commissions, customer support, leverage and platform functionality are just a handful of factors you must take into account before choosing a broker to work with.

In a Rush?

No time to read our comprehensive guide right now?

No problem. Following weeks of research, we’ve compressed the critical points and featured OUR broker of choice – FP Markets

Regulation

Most reputable brokers are regulated by respectable financial watchdogs. FP Markets is regulated by a number of regulatory bodies, including the Australian Securities and Investment Commission (ASIC).

Account types and platforms

FP Markets stepped it up here, offering not only multiple account types, but also a broad range of platforms, including MT4 and MT5, along with the very impressive Iress platform, a comprehensive package for professional traders.

ECN Pricing

FP Markets streams price feeds directly from liquidity providers.

Research and analysis

FP Markets have numerous industry experts active daily.

Leverage

Most reputable brokers are (or will be in the next couple of months) restricted to their offering due to recent regulatory intervention. The maximum leverage ratio for major currency pairs is 1:30.

Education

A continuous flow of educational material graces FP Markets dedicated Traders Hub.

Competitive commission structure

FP Markets states their EUR/USD spread to be 0.0 pips on average 37.2% of the time from 01-11-2020 to 30-11-2020 (available for their RAW Spread accounts).

Customer service

We personally tested FP Markets customer service. Wait times were incredibly low and the support team’s knowledge was fantastic.

Detailed Guide:

To make life a little simpler, we have shaped an easy-to-understand guide that highlights some of the heavyweight brokers in the industry and, more importantly, underlined key aspects to zero in on.

Regulations

Th market is a mammoth decentralised auction house, with a daily turnover of 6.6 trillion USD, according to the latest BIS Triennial Survey.

Knowing your money is safe is a number one priority. Ethical and dependable brokers are sought after, and for good reason.

Given the decentralised nature of increasing demand for (contracts for difference) products, the need for a dedicated financial watchdog is paramount. Regulated brokers are required to follow specific guidelines stipulated by the local regulatory body.

Regulated brokers are also subjected to audits from supervisory authorities. When a regulated broker fails to follow standards set by its regulator, legal action can be taken by the agency. You will find regulated brokers openly display regulatory information on their websites.

We recommend AVOID brokers operating under no regulatory body. Promises of guaranteed returns and extravagant bonuses, together with huge leverage, often lure unsuspecting. Those who choose to trade with unregulated brokers have limited support options should they suffer financial loss at the hands of a broker.

With a regulated broker provides peace of mind that you’re working with professionals, an organisation who encourage and support ethical rules and transparency.

Some of the more prominent regulatory bodies are listed below:

Business Model

How a broker operates its business can affect commission structure for.

The majority of brokers are a blend of A-Book and B-Book setups, often labelled hybrids.

In your quest to find a suitable broker you’ll come across other terms such as Dealing Desk, Non-Dealing Desk, ECN (Electronic Communications Network), STP (Straight Through Processing) and DMA (Direct Market Access). It is important you research these terms.

An ECN broker works by consolidating bid/ask prices from numerous liquidity providers. This frequently offers narrower bid/ask spreads. Think of an ECN as an aggregation engine, in place to connect and liquidity providers without the need for a middleman.

A STP broker is often referred to as a silent middleman between market. Orders are automatically routed to the broker’s liquidity providers, and prices are executed at the bid/ask rate provided by those liquidity providers. Usually, STP brokers have an internal liquidity pool that is represented by different liquidity providers, essentially competing for the best bid/ask spreads for STP broker orders.

The Hybrid model is a combination of both ECN and STP. Both STPs and ECNs operate as non-dealing desk brokers.

Direct Market Access (DMA) allows to execute trades directly on exchanges. DMA do not have to rely on market-making firms or dealers to carry out trades.

Leverage

Leverage is an important consideration for many.

Leverage essentially governs margin requirement. Higher leverage means less of an initial deposit is required to open a trade, while lower leverage demands a higher initial margin deposit.

Despite Australia and the United Kingdom being the main target markets in terms of , regulatory bodies governing these countries have effectively put a cap on the amount of leverage brokers can offer. The intervention order restricts leverage to maximum ratios of: 1:30 on major currency pairs and 1:20 on minor currency pairs.

For more information see here (ASIC) and here (FCA)

Many brokers have welcomed the new changes that largely affect retail clients. Professional clients, from what we understand, will not be affected.

Commissions and Spreads

‘Nothing is free. Everything has to be paid for’ – Ted Hughes

Cost to trade is an important consideration when choosing a broker.

Traditional market maker brokers, those managing a dealing-desk model, largely earn revenue through the bid/ask spread, either by way of a fixed or floating spread.

A spread, usually measured in pips (or in the case of a tight spread, pipettes) is the difference between willing buyers and sellers at any one time. For market maker brokers this will be your broker’s bid and ask prices.

The key difference between ECN and STP brokers in terms of commission structure is ECN brokers charge a fixed commission as spreads depend on the liquidity provider. STP accounts, however, generally add a mark-up to the spread, similar to a market maker.

If you’re broker states commission-free, the commission will be built into the spread.

Account Types

Dependent on the broker you choose to trade with, a number of account types are available.

It is important you look at this carefully – details are usually found under Account Types of each broker’s website. Some brokers also offer proprietary platforms.

The majority of brokers also offer demo accounts. These are simulated practice platforms that generally track live market pricing. This is a real plus for newer, allowing for things such as strategy testing in a risk-free environment.

For the purpose of this report, we researched two popular brokers:

FP Markets and IC Markets.

FP Markets, in our opinion, offers the more professional service of the two.

FP Markets offers Standard and Raw accounts, each with a minimum opening balance of 100 AUD or equivalent. Their Raw account, according to their website, is most popular, with spreads reaching as low as 0 pips in some instances. Commission per lot is around 3 USD per side on their Raw account, though with their Standard account it is commission free (spread is typically higher). Both accounts also work with ECN pricing. At FP Markets they also offer a selection of Iress account types. This is an awesome platform for the professional.

FP Markets noted the following regarding their Iress offering:

Iress is a comprehensive active platform with advanced functionality. What makes the Iress platform superior is transparent Direct Market Access (DMA) which allows for in shares and futures along with other non-DMA financial instruments such as indices, commodities. Trade over 10,000 stocks across international markets including the Australian Stock Exchange (ASX), New York Stock Exchange (NYSE), London Stock Exchange (LSE) and NASDAQ.

IC Markets, similar to FP Markets, offer a Raw Spread account and a Standard account, in addition to (third-party platform). Each account requires a starting deposit of 200 USD, with their Raw Spread Account being the most popular, according to their website. Their Raw Spread account list commissions of 3 USD and 3.5 USD, respectively, yet spreads are reportedly as low as 0 pips. Their Standard account, similar to FP Markets, comes with zero commission but has higher spread cost.

IC Markets noted the following:

Our Raw Spread account offers some of the lowest possible spreads available. Our average EUR/USD spread is 0.1 pips, with only a small commission of $3.50 per lot payable per side, with aggregated source of pricing from up to 25 institutional grade sources.

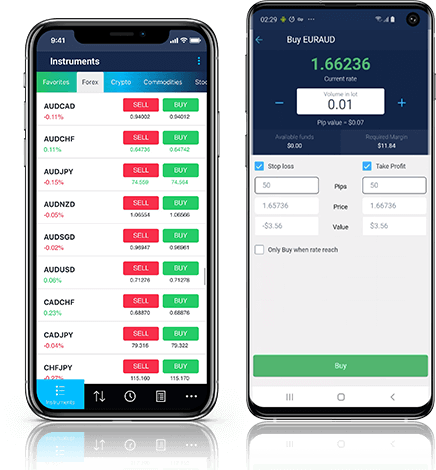

Platforms

The platform is where your trade execution takes place and for the majority of, where most analysis is prepared. This is why it is imperative to select a broker providing a platform that suits your individual needs. Ultimately, a good broker provides a range of platforms, in addition to mobile applications as some welcome the ability to trade through mobile devices.

The majority of brokers provide MetaQuotes Software: Meta 4 (MT4) and Meta 5 (MT5). MT4 remains a favourite among retail platforms, while MT5 usage is gradually increasing.

Other third-party solutions are often available, with some brokers designing proprietary platforms to fit the needs of their.

A particularly stand-out platform is the Iress platform, a new generation web-based trade station. According to our research there are only a handful of brokers that adopt this platform, including TradeMax Global Markets ( TMGM ) and FP Markets. While TMGM provides access to the Iress Viewpoint platform, FP Markets goes that extra mile and facilitates access to not only Iress Viewpoint, but also the Iress, Iress Investor and Iress Mobile platforms.

Both TMGM and FP Markets charge a fee for their Iress Viewpoint platforms, but is waived if, according to FP Markets, you trade 15 times (with a standard minimum ticket fee of 10 AUD) or more per calendar month or generate more than 150 USD in commissions to receive this platform free of charge.

FP Markets also go on to say that by through their Iress platforms, you’ll receive access to more than 10,000 Australian and international on stock exchanges across several continents.

Research & Analysis

Access to a full suite of tools and research is a benefit many welcome.

Global market coverage in one location that is (often) free of charge is a must for any aspiring.

Following industry experts is recommended to learn from their analysis, which, for the better brokers, is published daily. Another key thing to look for is defined research tabs. If you want to view research regarding technical analysis, for example, a dedicated page for this should be available.

The best brokers provide not only daily technical and fundamental research, they also cover week-ahead reports which effectively highlight key events to focus on and longer-term levels to be mindful of.

Another key consideration is social media. Many reputable brokers post regularly, underlining key macroeconomic events to be aware of. In addition, closing prices are often advertised along with technical charting opportunities.

Education

It can be difficult to find reliable education when learning to trade .

The appealing thing about most trustworthy brokers is their education offering.

We found that the best brokers have a dedicated hub that serves to educate its clients, highlighting things such as how to correctly operate platforms. Additionally, information on technical analysis is popular – aspects such as the correct application of chart patterns, for example. psychology should also be addressed as this is a large (though unfortunately overlooked) part of success.

Although each broker has their own take on format, the majority focus on articles in order to help educate newer about the workings of the market.

It is recommended seek a broker offering a comprehensive educational package that is FREE to access. In addition to articles, webinars are a must for many. This provides the option to ask industry experts in a live setting. Free downloadable E-books is also something you should look for.

Some brokers offer basic educational packages; others take it a step further and offer a consistent flow of educational material. Our advice is to focus on brokers that invest in their educational offering. This shows the broker respects and understands the needs of its.

Website Features

In today’s ever-growing world, synonymous with technology, the importance of a user-friendly website presence is important.

Having the ability to easily browse a broker’s website is a clear benefit. Another key element of user-friendly website design is mobile optimisation. Nowadays, users interact with websites through their mobile devices more than ever.

Customer Service

Irrespective of your experience level, customer service is indispensable.

the financial markets is a difficult enough endeavour, but without clear and concise means of contact with your broker, can be made very difficult.

It is recommended you test-drive a broker’s customer service a few times. Ideally, you must check their customer service have a contact phone number and an address. Another test, of course, is their live chat support. Response should be quick and the support team must be well-informed.

The importance of reliable customer service is tremendous. This will become evidently obvious if you encounter a technical issue during a trade.

Our Picks

FP Markets, IC Markets and Pepperstone are our brokers of choice.

Each command a trustworthy and reliable presence, with knowledgeable support and a broad range of platforms and financial instruments available.

Overall, however, FP Markets is our TOP PICK. Their professionalism, wide variety of platform choice and products represents a prime example of a first-class broker.

| Brokers under review | Recommended  |  |  |

|---|---|---|---|

Our Rating |  |  |  |

Established | 2005 | 2007 | 2010 |

| Account Application Time | 1 Business Day | 1 Business Day | 1 Business Day |

| Minimum Account Balance | 100 AUD (Lowest) | 200 USD | 500 USD (Highest) |

| Platforms | MT4, MT5, Iress | MT4, MT5 | MT4, MT5 |

| Account Types | Standard, Raw and Iress ViewPoint, Iress Investor and Iress | Standard and Raw Spread Accounts | Standard and Razor Accounts |

| Range of Markets | 10,000+ (Additional Share via their Iress Platform) | 300+ (Additional Futures Products) | 500+ (No Futures Products) |

| Leverage | 1:500 | 1:500 | 1:500 |

| Spreads/Fees | Low Spreads - Commission per side is 3.0 USD per one standard lot | Low Spreads - Commission per side is 3.5 USD per one standard lot | Low Spreads - Commission per side is 3.76 USD per one standard lot |

| Execution Speed | 36 Milliseconds | 40 Milliseconds | 30 Milliseconds |

| Regulation – Tier 1 Licences | ASIC; CySEC | FSA; AFSL | ASIC; FCA |

| Market Research and Education | 9 | 7 | 6 |

| Customer Service | 9.5 | 6 | 7 |

Trustpilot Reviews for FP Markets

Overall, however, FP Markets is our TOP PICK. Their professionalism, wide variety of platform choice and products represents a prime example of a first-class broker.

Start with The Broker Review's Choice- FP Markets