How Social Trading Can Be Profitable for Traders

Copy Top Profitable Traders that return over 100% per month.

Social trading continues to gain in popularity, and is here to stay.

Interest rates plummeting to zero—with some countries adopting a negative interest rate policy (NIRP)—has seen savers’ returns sink in recent years.

Fortunately, alternative investment options exist.

What is Social Trading?

Social trading is a simple solution that merges successful traders and willing investors. It represents a method of investing that allows investors to mirror the actions of experienced traders—be that in the foreign exchange market, the stock market, the bond market or the cryptocurrency market—and profit from their trading activity.

Why Trust Us?

The ForexBrokerReview website is a leading resource for online traders. Created by traders for traders, our research provides insightful information and extensive comparisons, exploring 100s of brokers. Our recommendations, therefore, not only help newer traders, but also old hands as well.

Security, regulation, commissions, customer support, leverage and platform functionality are just a handful of factors you must take into account before choosing a broker to work with.

In a Rush?

No time to read our comprehensive guide right now?

No problem. Following weeks of research, we’ve compressed the critical points and featured

Our Social Platform of choice – FP Markets

Start trading with The Forex Broker Review’s Choice

Find out our pick with detailed comparison

Trading the Financial Markets

The process a trader must undergo to achieve profitable consistency requires unyielding perseverance; a commitment many fail to honour and, as a result, a high percentage of traders throw in the towel. For what at first appeared a get-rich-quick avenue, trading can become one of the most exasperating endeavours an individual takes on. Most fail to realise the commitment needed to operate successfully in the markets.

Learning and applying concepts such as technical and fundamental analysis, as well as risk-management strategies, is a time-consuming process, and is particularly difficult in today’s modern world.

This is what makes social trading an attractive option for both newer traders and investors.

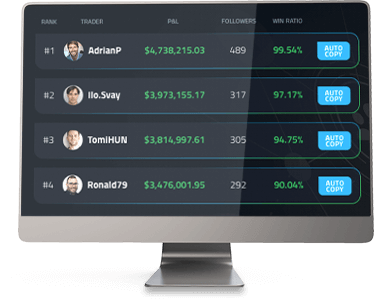

What’s impressive about social trading is the option of choosing which traders to invest with. Most reputable social trading platforms offer access to a ratings column, detailing features such as top-performing traders, all- time returns, trading history, and trading account details. It’s this transparency that makes social trading popular.

Start Trading with TheForexBrokerReview's Choice- FP Markets

Social Trading Platforms

A number of Forex brokers have adopted social trading applications.

One broker in particular that caught our eye is FP Markets.

With FP Markets, a globally regulated broker, traders have access to more than 10,000 financial trading instruments, including Forex, Shares, Indices, Commodities, and Cryptocurrencies.

Not only are FP Markets considered by many as a one-stop shop for Forex and CFD trading, they recently took things to another level and launched their in-house social trading feature. In addition to this,

FP Markets work with AutoTrade—a third-party social trading system provided through Myfxbook.com.

We did some digging and found FP Markets approach to social trading was simple, yet effective.

Available through both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), opening a social trading platform with FP Markets is quick and has a number of different funding options.

They also have an awesome method of filtering profitable traders through their Ratings tab. Here you’re presented with a catalogue of top-performing traders, detailing profitability. You can extend research by clicking on the trader of choice and viewing their trading details, displaying account balance and leverage profile, for example. You also have access to account statistics, trade statistics, and instruments traded.

Another impressive feature is the ability for an investor to alter their risk profile. Here the investor is able to specify things like minimum and maximum lots. For instance, if an investor sets a minimum of 1 standard lot, the provider with volumes lower than the specified selection will not be copied in your trading account.

Other options allow for the investor to adjust risk-management settings, such as setting the aggregated realised loss of all copied trades since joining the provider. When, or if, this level is reached, the subscription is archived. What’s more, Investors have the freedom to adjust their acceptable level of aggregated floating loss of all copied trades.