How to Choose a Forex Broker?

In a market exceeding US$6 trillion in daily turnover, selecting a Forex broker is an intimidating task for many new traders. Complicated language and an overwhelming choice of brokerages makes distinguishing between the respectable and unfit difficult.

Ultimately, the first step is taking into account your requirements. Are you a scalper executing several trades a day with a small account or a longer-term position trader operating a larger account size, and only engaging once a week? These are the types of questions you must answer prior to exploring the brokerage landscape.

Our assignment, therefore, is to peek under the hood and expose essential broker knowledge and emphasise correct

questions to ask a broker of interest.

Regulation and Safety of Funds

Due to the nature of the decentralised, or over-the-counter, Forex market, financial risk and fraud is a fundamental

concern.

Consequently, determining if a Forex broker supports regulatory compliance is a first port of call. Regulatory bodies oversee the operations of regulated brokers, administering strict rules and laws to safeguard investor accounts.

Regulatory and legal documents are (or should be) available on all regulated brokers’ websites and you are urged to review these thoroughly.

Aside from most regulated organisations subjected to guidelines such as the ‘Net Capital Rule’—requires brokers to hold sufficient (liquid) reserves to satisfy claims—regulation also ensures brokers segregate investor funds at leading global banking organisations. Client funds should never be used to meet broker expenses.

Top regulatory bodies to be aware of:

Question the broker’s regulatory bodies and ensure client funds are segregated.

Why Trust Us?

The Broker Review website is a leading resource for online. Created by for , our research provides insightful information and extensive comparisons, exploring 100s of brokers. Our recommendations, therefore, not only help newer, but also old hands as well.

Security, regulation, commissions, customer support, leverage and platform functionality are just a handful of factors you must take into account before choosing a broker to work with.

Customer Service

As retail FX and CFD trading continues to gain popularity, independent traders have become increasingly

demanding. And rightly so.

Following on from regulatory checks, a quality assessment of a broker’s customer service is a recommended second

port of call. Customer service is where traders and investors head for when things don’t go according to plan or need additional information.

Trustworthy brokers usually deliver a 24/7 customer service operation in a multilingual setting. The most popular

communication avenue is a Live Chat Service. Options to call, email and write should also be available, with contact addresses for all brokers’ offices accessible on their website.

It’s advised to test the customer service team’s response using their chat function on at least three occasions, preferably in the morning, then midday and in the evening. Waiting times should be short (less than a minute) and answers clear and to the point. There’s nothing worse than communicating with

incompetent representatives.

You may also consider running additional tests: calling the broker directly and evaluating email response.

In a Rush?

No time to read our comprehensive guide right now?

No problem. Following weeks of research, we’ve compressed the critical points and featured

Our Social Platform of choice – FP Markets

Broker Business Model

Recognising there’s a number of broker business models is imperative and is considered a third step in your search for a broker to work with.

Forex brokers operate either through a dealing desk or a non-dealing desk model, as well as a ‘hybrid’ between the two. They may also be referred to as A-book (counterparty to client trades but directs orders [risk] to liquidity providers) and B-book (market makers—liquidity providers that retain client positions on their books).

Dealing desk models (B-book) create liquidity for clients—the counterparty—and are often stated as ‘market makers’. Trading with a market maker, nonetheless, does open up a potential conflict of interest. However, most well-known reputable brokers, which work similar to dealing desks in large financial institutions, simply provide liquidity. It’s also important to realise market makers can (and do) offer fixed spreads, though some provide a variable spread and commission-based structure.

A non-dealing desk operation (A-book) remains the counterparty to your trades though offsets the position upstream to liquidity providers. ECN brokers (an aggregation of quotes from multiple liquidity providers), STP brokers (orders routed to a broker’s liquidity provider) and DMA brokers (access to a genuine exchange price feed) are normally classified as non-dealing desk brokerages. Brokers in this category work with what’s known as variable spreads and commission arrangements.

Ultimately, as long as the broker is reputable, using either a dealing desk or non-dealing desk system is an option.

Fees and Commissions

Fees and commissions are an important element in broker selection. Understanding how a Forex broker generates revenue is the next proposed step in your broker quest.

When speaking with traders, the term ‘spread’ is commonly brought up in conversation. Spread refers to the difference between the Bid (the price traders can sell) and the Ask (the price traders can buy): the Bid/Ask spread.

It is suggested to enquire whether the broker adopts a variable or fixed spread system. Points to be aware of are a fixed spread tends to remain within a fixed range (2-3 pips, for example) irrespective of market volatility. Variable spreads, as the name implies, varies dependent on market volatility. If a broker is selected that adopts a fixed spread,concerns regarding spread widening during periods of volatility is lessened. Yet, if you normally trade in active market sessions, you may find variable spreads offer a cheaper alternative than a fixed spread market.

Commissions vary among Forex brokers, an amount deducted from your account equity prior to executing a trade. Swap is another consideration for traders who keep positions open overnight (beyond 17:00 pm EST).

Some brokers also have inactivity fees to consider; others support a no-fee structure on deposits and withdrawals. These are points worth asking brokers about, enabling a clear comparison. Ways of avoiding inactivity fees are by executing a trade on your account.

The key takeaway, of course, is to fully understand the commission structure before opening an account with a broker. Reputable Forex brokers have this information displayed on the website in an easy-to-read format. Contact their customer support if unsure of any terminology.

Also, question the broker to ensure what leverage rate you’re eligible to receive as this affects the initial margin percentage rate you receive.

Market Coverage

By this point, you should have shortlisted the worthiest brokerages. Further refinement is necessary, however.

While most Forex brokers offer a wide range of currency pairs to trade, traders may elect to explore additional markets, such as individual shares, indices, commodities and cryptocurrencies, for example. The majority of respectable Forex brokers provide a dedicated webpage demonstrating the key markets they offer.

The best brokerages will at least offer access to more than 40 currency pairs (major, minor and exotic currency pairs), individual shares, commodities, major stock indexes and cryptocurrencies.

Does the Forex broker provide the financial instruments you wish to trade?

Confirm the shortlisted Forex brokers cover your traded markets, as well as facilitates access to a range of alternative markets.

Account Types

Account types differ across the broker spectrum, as does minimum investment (starting deposit). Below is an overview of the various account types you may come across.

Standard Accounts are common among Forex brokers, generally carrying a higher variable ‘spread cost’ though areoften accompanied with a zero-commission arrangement. Given the higher spread, these accounts are favoured among swing traders and position traders (longer-term market participants).

Additional Accounts alongside the standard offering—often adopting different account labels, such as ‘Raw Account’—commonly take on a lower variable spread range, but are usually subject to commissions (per lot). You’ll see scalpers and day traders favour these account types, encouraged by lower spreads.

Bottom line, read account features before a decision is made to ensure it meets your personal (and financial) needs. If uncertain, contact their customer support team and request further clarification.

Start with The Broker Review's Choice- FP Markets

Fast Account Opening in 3 Simple Steps

the Financial Markets

The process a must undergo to achieve profitable consistency requires unyielding perseverance; a commitment many fail to honour and, as a result, a high percentage of throw in the towel. For what at first appeared a get-rich-quick avenue, can become one of the most exasperating endeavours an individual takes on. Most fail to realise the commitment needed to operate successfully in the markets.

Learning and applying concepts such as technical and fundamental analysis, as well as risk-management strategies, is a time-consuming process, and is particularly difficult in today’s modern world.

This is what makes social an attractive option for both newer and investors.

Broker Business Model

Recognising there’s a number of broker business models is imperative and is considered a third step in your search for a broker to work with.

Forex brokers operate either through a dealing desk or a non-dealing desk model, as well as a ‘hybrid’ between the two. They may also be referred to as A-book (counterparty to client trades but directs orders [risk] to liquidity providers) and B-book (market makers—liquidity providers that retain client positions on their books).

Dealing desk models (B-book) create liquidity for clients—the counterparty—and are often stated as ‘market makers’. Trading with a market maker, nonetheless, does open up a potential conflict of interest. However, most well-known reputable brokers, which work similar to dealing desks in large financial institutions, simply provide liquidity. It’s also important to realise market makers can (and do) offer fixed spreads, though some provide a variable spread and commission-based structure.

A non-dealing desk operation (A-book) remains the counterparty to your trades though offsets the position upstream to liquidity providers. ECN brokers (an aggregation of quotes from multiple liquidity providers), STP brokers (orders routed to a broker’s liquidity provider) and DMA brokers (access to a genuine exchange price feed) are normally classified as non-dealing desk brokerages. Brokers in this category work with what’s known as variable spreads and commission arrangements.

Ultimately, as long as the broker is reputable, using either a dealing desk or non-dealing desk system is an option.

Social Platforms

A number of brokers have adopted social applications.

One broker in particular that caught our eye is FP Markets.

With FP Markets, a globally regulated broker, have access to more than 10,000 financial instruments, including, Shares, Indices, Commodities.

Not only are FP Markets considered by many as a one-stop shop for, they recently took things to another level and launched their in-house social feature. In addition to this,

FP Markets work with AutoTrade—a third-party social system provided through Myfxbook.com.

We did some digging and found FP Markets approach to social was simple, yet effective.

Available through both Meta 4 (MT4) and Meta 5 (MT5), opening a social platform with FP Markets is quick and has a number of different funding options.

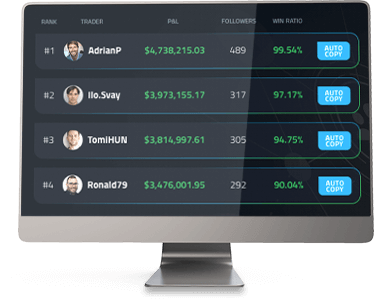

They also have an awesome method of filtering profitable through their Ratings tab. Here you’re presented with a catalogue of top-performing, detailing profitability. You can extend research by clicking on the of choice and viewing their details, displaying account balance and leverage profile, for example. You also have access to account statistics, trade statistics, and instruments traded.

Another impressive feature is the ability for an investor to alter their risk profile. Here the investor is able to specify things like minimum and maximum lots. For instance, if an investor sets a minimum of 1 standard lot, the provider with volumes lower than the specified selection will not be copied in your account.

Other options allow for the investor to adjust risk-management settings, such as setting the aggregated realised loss of all copied trades since joining the provider. When, or if, this level is reached, the subscription is archived. What’s more, Investors have the freedom to adjust their acceptable level of aggregated floating loss of all copied trades.